Anti-Corruption Helpline by IIM students–Need of the hour!

2G scam, Commonwealth Games Scandal, Adarsh Housing Society Scam, Corporate Loan Bribery scandal – Are you tired like me of hearing about scandals day in and day out? Are you in the same boat like me having lost trust in the system? Are you thinking that everything would be forgotten in a few days / weeks.

Here’s an interesting piece of news which has re–instilled a bit of my faith in the system. Six students (Ravi Yadav, Udit Goyal, Saurabh Singh, Nikhil Bhaskar, Shantanu Sekharof IIM Ahmedabad and Daniel De Luna, an exchange student from Italy) have decided to come forward and start an anti corruption helpline.

So what gave them the idea of leaving their cozy high paying jobs to start a helpline?

The biggest reason according to the six of them was the pain at seeing multiple scams rocking the country and people having no idea whom to complain too. This prompted the 6 of them to approach Abdul Kalam and IIM A professor Anil Gupta who more than agreed with their idea.

So what’s their business idea?

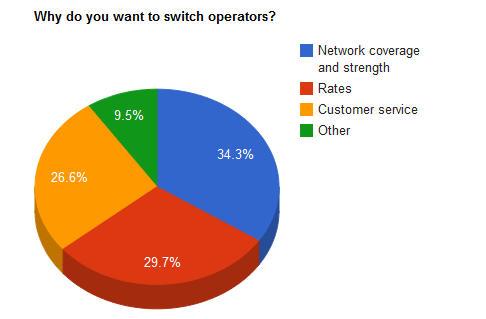

The students have conducted a market research regarding the need for such a helpline. This, along with the fact that they have visited the Anti–Corruption Bureau and also other police agencies, shows that they are really serious for this kind of work.

Their model envisages getting the complaints from people, scrutinising it by specially recruited retired officials and finally forwarding the complaints to the right agencies. Their main aim is to address only the useful calls and prevent the umpteen frivolous calls they would get. Therefore they plan to raise the charge for a call to Rs 5 or 10. For this they plan to integrate their anti–corruption helpline with the Anti Corruption Bureau. They aim to consult people and make them aware of their rights and where they are being cheated.

Initial success

Their plan has been forwarded by a politician to the state department. They have also enlisted a telecom provider to provide the toll – free status for the helpline. Another feather in their cap is the fact that Gujarat Anti – Corruption Department has shown a keen interest in their model.

But the road is fraught with CHALLENGES, CHALLENGES and more CHALLENGES!

here have been examples of various projects by students / youngsters across the nation which may have been related to helping the country at some level or the other. But sadly only IIMs and IITs ones are noticed. But then, even they are noticed when they start, while afterwards no one knows what happened to them.

Since the idea is based on a very touchy topic, six of them are sure to face lot of struggle initially to make people understand that they are not a fly by night operators (one who would probably make a lot of money in this) but someone who is really serious. Since a large part of our police force as well as politicians are involved in CORRUPTION, the idea would be even difficult to propagate.

The business model is something which has to be decided. Since they say that it would be a helpline, would it model into a consultancy into the future, probably helping in the complete process of filing complaints and getting to see the results or it would remain the same – that of a helpline?

Other aspects like awareness through word of mouth, getting the right people to work, paying them their salaries which are linked to getting the right financial support, being on the right side of the law while solving problems etc. are some of the other issues which need attention.

Though the idea sounds fantastic and excellent especially for a country like ours, the great six need to make sure that the glow to help the country keeps burning in their hearts and not let the idea die a natural death!

What are your views?